Price declines slowing in wholesale market, accelerating in retail

Image courtesy of CARFAX.

While the groundhog hasn’t delivered his forecast yet, it seems spring might be on the way in the wholesale car market.

Used-vehicle prices were down again as January ended, but the pace of depreciation is decelerating, according to the latest report from Black Book.

“For three consecutive weeks, the overall wholesale market has exhibited a slowdown, with reduced depreciation rates recorded in both the car and truck segments,” the report said. “Additionally, there has been a slight increase in auction conversion rates. Taken together, these indicators might suggest the onset of an early spring market.”

Prices were down 0.33% for the last week in January, compared to a 0.49% decline the previous week, while 8-16-year-old vehicles were “demonstrating modest signs of spring,” the report said, with five segments showing price increases.

On a volume-weighted basis, the overall car segment decreased -0.26% after dropping by 0.37% a week earlier, while 8-to-16-year-old cars were down just 0.07%.

Compact cars were the only segment in the overall market with a price increase, up 0.29%, while the prestige luxury car segment was down 0.91% and has averaged a weekly decline of 0.99% over the past 12 weeks. Subcompacts had the largest decline at 1.30%.

“The subcompact car category stands as a notable exception” to the trend of slower price declines, the report said, “posting the largest decrease among car segments for the third week running – a trend that is somewhat unexpected given the typically lower price point of these vehicles.”

Truck segments also showed a slower decline for the week, 0.36% compared to 0.53% from the previous week, with only full-size vans showing an increase at 0.09% – its first appreciation since July 2022. Just two months earlier, that segment was down more than 2%.

And while subcompact crossovers had the largest drop at 0.68%, that was its smallest decrease in a week since mid-October.

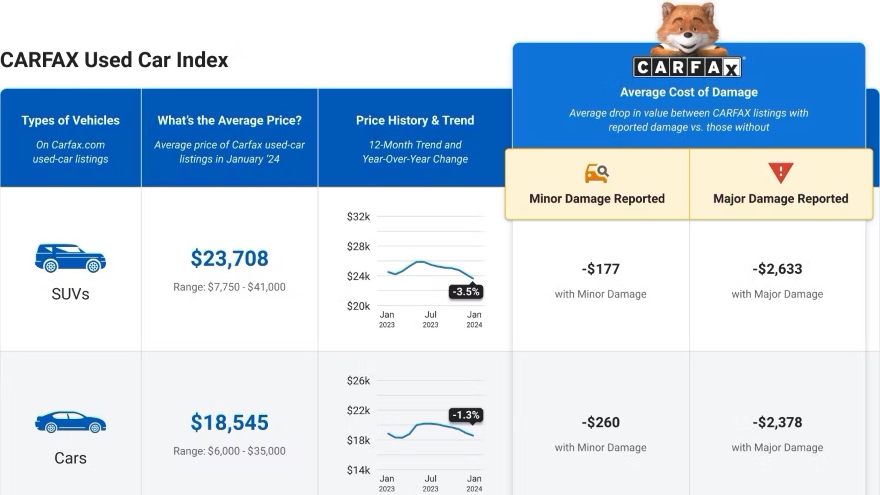

CARFAX report: New-car deals help fuel price drops

As opposed to the wholesale market, used car retail price decreases actually accelerated in January, according to CARFAX’s latest report on that market.

The CARFAX report attributed that trend to new-car inventory, which the report said is at its highest level in three years.

“That means more low-interest financing and more cash-back deals from automakers,” the report said. “In turn, that is helping to drive down the cost of used cars.”

Among the segments, only pickup trucks cost more than a year ago, and they are up just 0.9% year-over-year. Average prices have dropped from $400 to more than $1,000 month-over-month in every category.

“The high end of each category’s price range has also fallen by at least $1,000 as dealers act to move the most expensive used vehicles,” the report said.

More used cars are expected be hitting the market soon, the result of a boom in car sales three years ago sparked by government stimulus checks following the pandemic drop in 2020. But, CARFAX said, those vehicles won’t be enough to return the market to normal just yet.

“Inventory is still millions below normal, and certified pre-owned cars, in particular, are hurting because leasing dried up in 2021,” the report said. “Fewer leases mean fewer cars being turned around by their owners.”

CARFAX said the accelerating price drops show “no clear sign” of slowing anytime soon, but cited luxury SUVs as a potentially attractive segment. Its average price on CARFAX is down about $1,000 since the start of the 2024 and about $4,000 since its peak on May – a 10% drop.

Pickup trucks, luxury cars and vans all dropped $800 month-over-month, while SUVs and hybrids/EVs fell an average of $700. Cars were down $400.

The report said predicting retail used-car prices is difficult, but noted several factors that will affect the market, including an a continued shortage in used-car supply from the effects of the COVID pandemic, and the Federal Reserve’s announcement that it is not raising interest rates for now.

“While the Fed’s interest rate isn’t directly tied to consumer borrowing rates,” the report said, “the lack of a rate hike does suggest that we’re near the top of loan rates for the time being.”

View The Latest Edition

View The Latest Edition