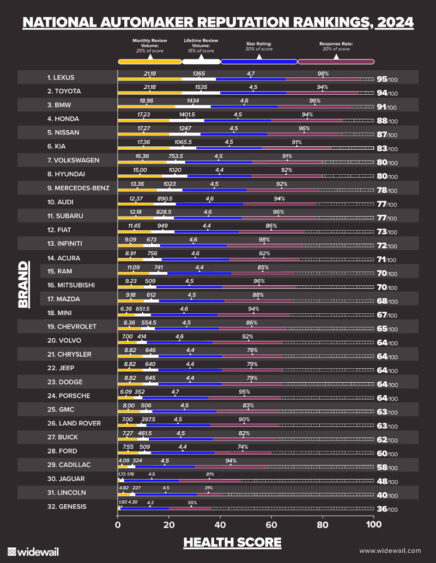

Widewail recently released the 2024 Widewail Brand Scorecard, a study of the reputations and sentiments of 32 automotive manufacturers across the United States. Lexus earned the highest reputation ranking among all automotive brands. Toyota and BMW ranked second and third, respectively.

The study analyzed 4 million Google customer reviews across 14 luxury and 18 non-luxury automotive brands. 1.1 million reviews were used for topic analysis. The Brand Scorecard ranks automotive brands using Widewail’s proprietary reputation “health score,” a diverse methodology that reveals the full picture of any brand or dealer’s reputation and assigns a 0-100 rating. The factors incorporated within the report include regional performance, detailed brand sentiment performance across 27 topics, reputation performance, best-selling model performance and top-rated dealers.

“There’s more competition than ever across the automotive retail industry, and reputation is a powerful differentiator that can meaningfully impact search ranking and sway customer decision-making in the car buying process,” said Matt Murray, CEO of Widewail. “Our 2024 Brand Scorecard is designed to provide automotive brands with a clear picture of what their customers say, how they stack up against their competition, and what factors drive their reputations. Lexus earned the top spot for reputation thanks to its high monthly review volume, an exceptionally high rate of response to reviews and a very low percentage of negative reviews.”

Why Lexus Ranked Highest

For the calendar year 2023, Lexus, whose health score is 95/100, received a median monthly review volume of 21.2. Lexus’s median lifetime Google rating is 4.7/5. The company responded to 98% of its reviews, and only 8% of the total reviews left by Lexus customers were negative. Interestingly, Lexus and Toyota had the same median review volume, but Lexus edged out Toyota thanks to slightly higher ratings and a 4% higher response rate.

The median monthly review volume benchmark across all automotive brands in calendar year 2023 is 10.4.

An analysis of review topics revealed that Lexus service is mentioned in 18.5% more positive Lexus reviews than the industry benchmark. Combined with 20.9% fewer negative mentions of repairs, 14.2% fewer negative mentions of communication, and 14.6% fewer negative mentions of service, Lexus customers enjoy a premium service experience. On the sales side, Lexus earned 7.4% above the industry benchmark for positive mentions of staff and 26% higher positive mentions of professionalism.

For Lexus, Minnesota represents its highest average monthly review volume state, attributed to Lexus of Wayzata, at 161.9 reviews per month in 2023.

Lexus’ best-selling vehicle, the Lexus RX, averages a 4.6/5 rating according to customer reviews that mention the model name.

The Top 3

Toyota ranked second on the Brand Scorecard, earning a health score of 94/100. The driving factors for its ranking are outstanding review volume and good performance across other categories. Toyota’s monthly median volume is 21.2, the same as Lexus, but its median lifetime star rating is slightly lower at 4.5/5. Toyota responded to 94% of reviews, 12% of which were negative.

Toyota’s topic distribution largely falls in line with industry benchmarks. However, service helped its ranking, with 11.3% fewer negative service mentions and 13.5% fewer negative repair mentions, meaning comments related to an unsatisfactory repair are coming up less often in reviews left for Toyota than the industry.

BMW earned the third spot on the Brand Scorecard, with a health score of 91/100. BMW’s health score was bolstered by standout positive performance in both service and communication. Compared to industry benchmarks, customer reviews revealed 21.2% more positive mentions of service and 34.8% more positive mentions of communication.

Other Highlights Revealed in the 2024 Widewail Brand Scorecard Study

- The study analyzed Google reviews of 32 automotive manufacturers with four of the top 10 brands from the luxury category.

- The top five ranked brands beat industry benchmarks in the most influential service categories: service, communication, wait times and repairs. As the leading drivers of negative reviews, top-ranked brands consistently outperform in these areas.

- Genesis and Lincoln, whose health scores ranked them at the bottom of the list, have unusually low review volume and poor response rates. Such a lack of customer engagement is surprising for two luxury brands.

- Import brands dominate the rankings. The first American brand on the list is RAM, which secured the 15th overall spot.

To learn more about the 2024 Widewail Brand Scorecard, visit the website here.

Methodology

The total sample size considered was 4,000,000 Google reviews. Of that three million, 1.1 million were considered for the topic analysis. The reduction is attributed to the length of the review, as reviews must be long enough to be analyzed for content.

(Note: Widewail primarily used the median when calculating benchmarks due to the highly skewed nature of the dataset.)

The “health score” consists of four components: 30% rating, 30% response rate, 15% lifetime volume (what consumers see on Google) and 25% median average monthly volume in 2023.

When looking at star rating, Widewail uses an “adjusted rating,” unique from lifetime rating (what you see on Google) and monthly average rating in 2023. The method considers the fact that dealerships on the list receive a wide range of monthly review volume, in part due to varying levels of opportunity. For example, luxury brands generally do not sell as many cars as non-luxury brands, the price point limiting a luxury dealership’s market. The adjusted rating concept uses the mathematical technique of additive smoothing to create an unbiased ranking method to rank two otherwise unequal dealerships.